By Christina Ameln, Sustainability Strategist and Advisor –

First published by the Vietnam Investment Review in its annual Sustainable Development Magazine 2023 – Taking Responsibility with a broad distribution at Vietnam’s development events and COP28 in UAE in November, 2023.

Sustainability reporting involves companies disclosing their environmental, social, and governance (ESG) progress to key stakeholders, including investors, customers, employees, etc. It has been around for some time. The quality of sustainable reporting varies significantly, from non-existent to excellent.

One market that is pushing the change towards excellence in sustainability reporting is the EU, through its Corporate Sustainability Reporting Directive (CSRD). This directive has a potential to be game-changing far beyond EU borders, even here in Vietnam.

The background to this directive is the European Commission’s Green Deal, which aims to reduce Europe’s greenhouse gas (GHG) emissions by 2030.

The EU realises that to meet these goals and direct finance towards a more green economy, all stakeholders have to be part of the process, including financial market players such as investors, banks, and companies.

The main challenge is that for investors to invest in sustainable companies, there has to be better clarity and alignment in the disclosure of their sustainability activities. As sustainability reporting currently ranges from the non-existent to excellent, there is no alignment in in- formation, data, and process making it hard to make well-informed investment decisions with sustainability. CSRD aims to change this.

WHAT IS CSRD?

An update to the EU’s previous Non-Financial Reporting Directive, the first set of companies must start the reporting under the CSRD in 2024. The CSRD is the regulation and the European Sustainability Reporting Standards is the framework that these corporates must use to report. These standards set the sustainability bar quite high by asking for reporting on four broad categories including cross-cutting (for example strategy and governance); environment; social; and governance.

The EU has also increased the scope of companies that must report to include EU companies, non-EU companies, subsidiaries and smaller businesses that adhere to certain criteria, it wants companies to do a double materiality assessment, have mandated limited third-party assurance; and incorporated administrative sanctions for non-compliance. It aims to bring sustainability reporting on par with financial reporting by also having the sustainability reporting included in management reports. This not only impacts companies in the EU but will have a far-reaching impact even here in Vietnam, since it addresses a larger pool of companies. Those that do not fall under the CSRD scope might still get questions for data from companies they work with that need to adhere to the directive.

But before you disclose your ESG information, you need to know what you are reporting on.

WHAT IS DOUBLE MATERIALITY?

A key first step in the reporting process under the CSRD is for companies to conduct a double materiality assessment. Traditionally, the approach has been one-sided.

Materiality, as a business concept, means identifying information that is most important and relevant to the company and its stakeholders, and determining how it will impact the company’s financial performance. In sustainability reporting, a company includes what ESG is most relevant (most material) to its business and what ESG criteria will impact the financial resilience of the company.

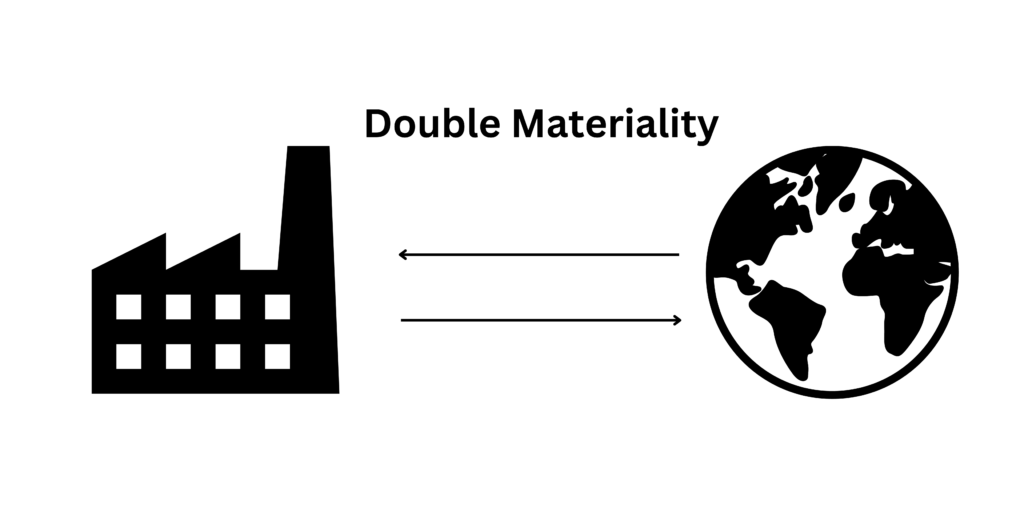

What is game-changing about the new regulations is that, in addition to the traditional outside-in approach, the CSRD is asking companies to assess the impact the business has inside-out on people and the planet in the short, medium and long term. And not only within the walls of the company but through their entire value chain.

With CSRD, double materiality will mean looking in both directions: the financial impact of outside-in and the impact materiality of inside-out.

So, for example, in a traditional materiality approach a company would report on the cost savings of using renewable energy (financial materiality). With the double materiality approach, a company would also report on the improved environmental impact of making this switch such as reductions in GHG emissions (impact materiality).

There are many benefits in doing a double materiality, including corporate transparency, increasing stakeholder engagement, strengthening corporate reputation, allowing companies to focus resources on the right things, preparing for threats and opportunities, providing better understanding to develop a stronger strategy and management processes, and attracting investors.

Following a double materiality assessment, companies can understand what ESG risks and opportunities are relevant to their business, what items are relevant to the company and what relevant standards to report on. It allows a company to really know what is going on.

WHY SHOULD YOU CARE?

It is easy to question why a directive adopted far away would have impact here in Vietnam. What stands out is the wide reaching impact the directive will have because it requires extensive data collection and disclosures from companies of all sizes.

It will also demand more data across the value chain (the chain of activities it takes to create a product from start to finish) including from the supply chain partners of EU companies.

As Vietnam is a key manufacturing hub and a key supply chain partner to the EU, the CSRD will impact Vietnam companies whether they are under the CSRD scope or not. As CSRD companies conduct their double materiality assessments and ask their value chain (from business partners to supply chain) to provide ESG data, it is clear that supply chain questions do not stop at the borders of the EU – this will include the supply chain in Vietnam. Understanding impacts, risks, and opportunities will include direct or indirect business relations upstream and/or downstream. This will also be supported by the Corporate Sustainability Due Diligence Directive (CSDDD) with its focus on due diligence in the supply chain.

CSRD companies will have greater responsibility from their own operations as well as all aspects of their supply chains. A consequence will be that they will prefer to work with suppliers that understand, work and report on sustainability, and recognise their need for sustainability information as a company under the CSRD scope.

Meanwhile, a challenge to sustainability in Vietnam is the data and reporting gap. According to PwC’s Vietnam ESG Readiness Report 2022, Vietnamese companies have strong ESG ambitions. Yet 70 per cent of lack understanding of data required for reporting and an equal number have very limited ESG reporting capabilities.

Furthermore, only 36 per cent of Vietnam companies use external parties to validate their ESG disclosures. This indicates that there will be a big leap in understanding and implementing sustainability reporting.

However, it appears that we do care here in Vietnam. The PwC report cited highlights that 80 per cent of Vietnam companies have made ESG commitments or plan to do so in the next 2-4 years. Vietnam’s strong commitments to reduce its GHG emissions by 2030 and achieve a net-zero carbon emission target by 2050, will hopefully accelerate this process.

As various sustainability directives move to reshape how financial market players – from investors to corporates – engage with sustainability, it is important to understand what is required, be prepared and take appropriate actions.

We need to understand both the financial and non financial impacts and elevate reporting before the directive comes knocking on our corporate doors. The knock could come from the EU or even closer to home. We need to be ready.

All views and opinions expressed on this site are those of the individual authors and comments on this site are the sole responsibility of the individual contributor.